Do you know what taxes, cash flow problems, and death have in common? There’s no escaping them!

Small business owners are often tackling every aspect of their business alone. From sales to marketing to deliverables, most businesses feel satisfied once they’ve made their balance sheet and income statement.

But that’s where you’re making a great mistake. Cash flow is one of the most important financial documents you can make for your business.

The first step to creating a financial cash flow and realizing its importance is to know what it is! In this blog post, we’ll tackle what cash flow is, how to calculate cash flow as well as an example to help you get started.

What is Cash Flow?

Cash flow refers to the movement of money into and out of a business over a specific period, typically tracked monthly, quarterly, or annually.

It encompasses all sources of cash inflow (cash coming in) such as sales revenue, investments, and loans, as well as cash outflows (cash going out) like expenses, salaries, and debt repayments.

You can represent your business’s cash flow by creating a financial statement known as a cash flow statement. These statements can show you one of the 2 situations:

- A positive cash flow indicates that a business has more money coming in than going out, ensuring financial stability and liquidity.

- A negative cash flow means expenses surpass income, potentially leading to financial challenges.

Types of Cash Flow

Cash Flow from Operations (CFO)

Also known as operating cash flow, this type of cash flow represents the cash generated or used by a company’s core operational activities, such as selling goods or providing services.

It provides insight into the company’s ability to generate cash from its day-to-day operations. CFO includes cash received from customers, minus cash paid to suppliers, employees, and other operational expenses.

A positive CFO is generally a good sign, indicating that the company can sustain its operations and potentially invest in growth or repay debt without relying on external financing.

Cash Flow from Investing (CFI)

Cash flow from investing activities refers to the buying or selling of long-term assets and investments. This category includes cash flows associated with purchasing or selling property, equipment, investments in other companies, and loans made to other entities.

CFI can be either positive or negative:

- A positive CFI often indicates that the company is investing in its future growth, such as expanding its facilities or acquiring new businesses.

- A negative CFI may suggest that the company is divesting assets or paying off debt.

Cash Flow from Financing (CFF)

Cash flow from financing activities focuses on the cash inflows and outflows related to a company’s capital structure. It includes activities like issuing or repurchasing stock, borrowing or repaying loans, and paying dividends to shareholders.

A positive CFF typically arises from raising capital through debt or equity issuance, while a negative CFF results from repaying debt or distributing dividends. CFF provides insights into how a company manages its capital and financial obligations.

However, a negative CFF might indicate that the company is reducing debt or returning capital to shareholders, while a positive CFF suggests that the company is raising funds, often for expansion or other investment purposes.

Cash Flow Formula

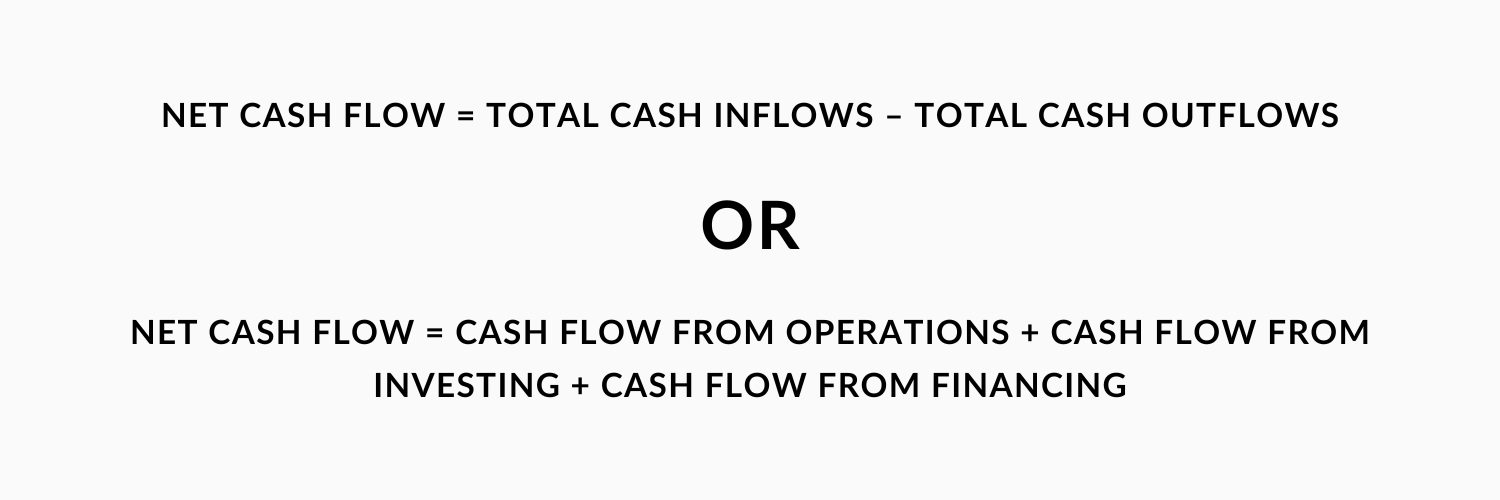

Net cash flow is an increase or decrease in the amount of cash during a specified period, within your business. You can calculate it by:

Difference Between Cash Flow and Revenue

Revenue means the income you earn from selling goods or services. The money for these transactions doesn’t have to be realized (received physically) for it to be counted as revenue.

So if you’ve dispatched an order of $500 to a customer, you can write down a revenue of $500 before you receive the money.

However, with cash flow statements, you only represent the actual cash flow of the company. The same $500 will only count when it’s in your bank account!

Difference Between Profit and Cash Flow

Profit and cash flow are essential financial metrics for businesses, each with distinct roles in assessing financial health.

Also called net income, profit represents earnings in a specific period, calculated by deducting all expenses from revenue. Cash flow tracks actual money movement, reflecting the closing cash balance after all inflows and outflows.

Positive cash flow indicates efficient cash management, while low profitability may result from high expenses or non-cash factors like depreciation. Conversely, higher profits might coexist with negative cash flow if you’ve made investments into assets recently!

Their purposes differ, too. Profit gauges overall financial performance and sales, vital for long-term goals and attracting investors.

On the other hand, cash flow ensures short-term liquidity, safeguarding your business against operational disruptions or cash shortages. Investors often scrutinize cash flow statements when considering business investments. So if you’re looking to have some investments in your business, it’s a good idea to focus on your cash flow statements and squash any current cash flow issues!

What is a Cash Flow Statement?

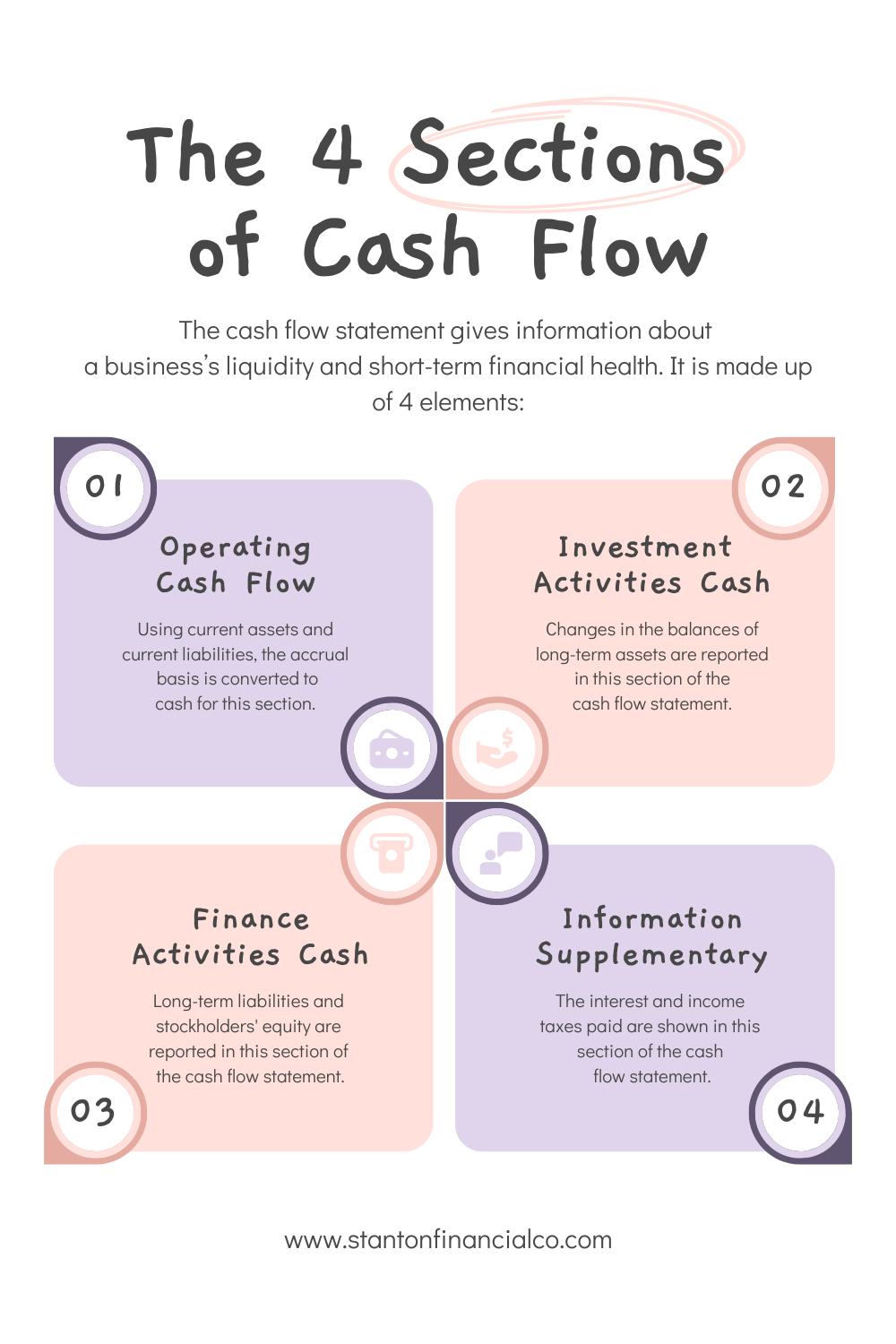

A cash flow statement is a financial document that provides a comprehensive view of a company’s cash inflows and outflows during a specific period, typically a month, quarter, or year. It is an essential financial tool used to track how money moves into and out of a business.

The primary purpose of a cash flow statement is to help business owners and stakeholders understand the liquidity and financial health of the company, ensuring that it has enough cash on hand to meet its short-term obligations and operational needs.

Every big corporation diligently prepares a cash flow statement. But what nobody talks about is how crucial a statement of cash flows is to small businesses too! Even if you don’t run a business and are looking to smartly manage your personal finances, a good cash flow statement can change the game.

A well-prepared cash flow statement provides a clear picture of a business’s financial stability, its ability to manage its cash resources, and whether it can seize opportunities or weather financial storms.

This transparency is invaluable for making informed decisions, securing financing, and ensuring the long-term viability of a small business!

A typical cash flow statement includes three main sections:

- Operating activities,

- Investing activities, and

- Financing activities!

Cash Flow Statement Example

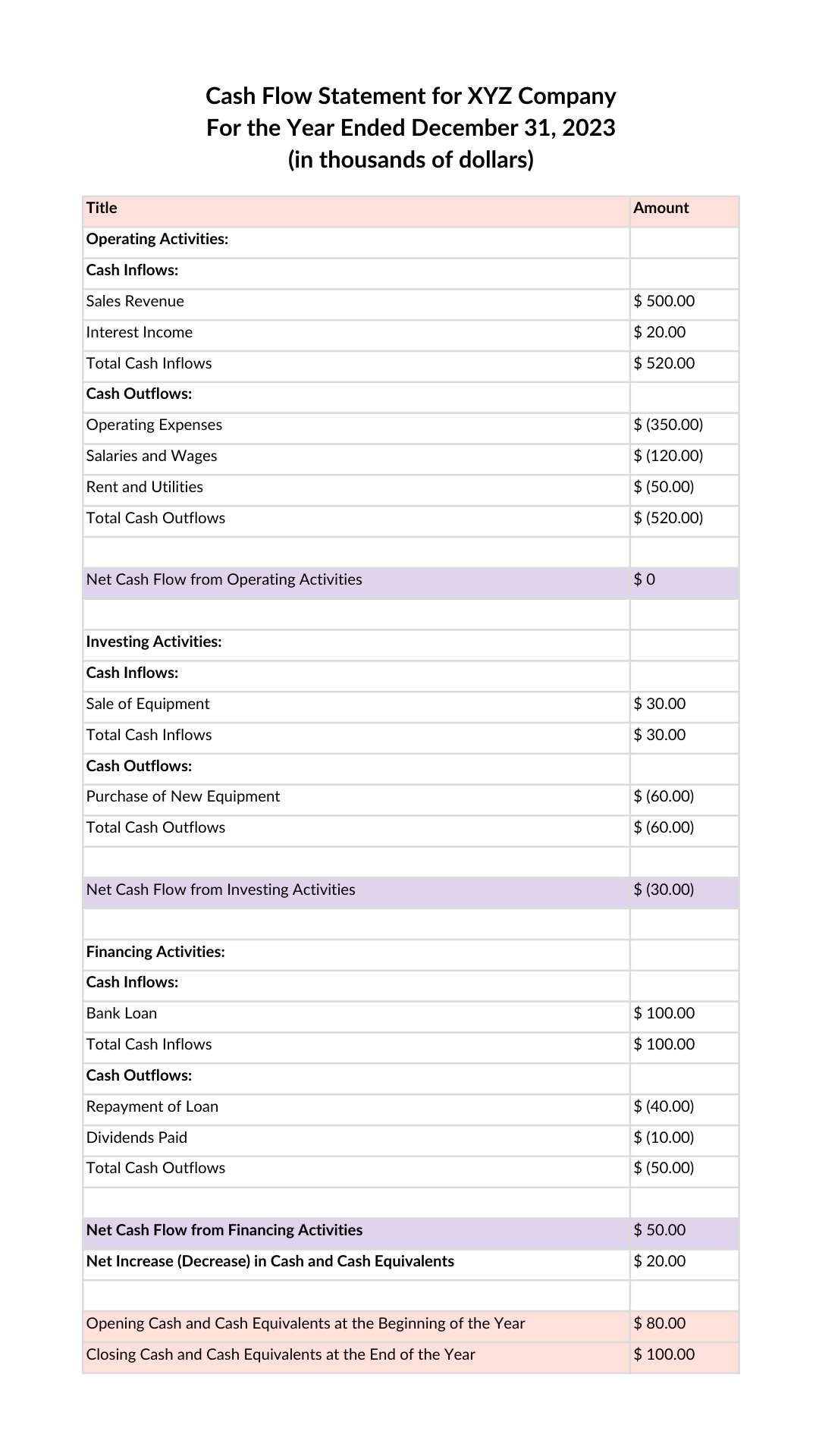

Now that you know what a cash flow is, here is an example of a cash flow statement for small businesses:

Final Thoughts

In easy words, cash flow is the money coming in and going out of any business. Businesses should aim to have a positive cash flow or total cash equivalents because it means you earn more than you spend.

We hope that this blog was helpful in explaining what cash flow is and how you can make one for yourself today!

Destress Financially With Stanton Financial Co.

If you want to dive head over heels into being the creative mastermind of your brand, Stanton Financial Co. can help you.

Stanton Financial Co. is a premium bookkeeping and CFO service that brings big business strategies to small businesses, solopreneurs, influencers, and content creators.

Unlike most bookkeeping services, we make it easy for you to profitably manage your fluctuating income. Collaborate with brands and focus on doing what you do best– we’ll take care of everything else!