Starting your business isn’t an easy feat. From people skills to sales and negotiations, there’s a lot on the plate of a small business owner.

But the worst of them all can be taxes… if you don’t know how to do them right and smart!

Many of our clients don’t know where to start when it comes to filing taxes or managing them throughout the year. Plus, with over 6000 pages of the IRS code on tax forms, it’s not really a quick study.

So in this blog post, we’ll tackle the most common tax forms and terms that small business owners like you should have up their sleeves!

Ready to be tax-smart from today? Let’s start with the…

Most Common Small Business Tax Forms

Forms, forms, forms… Pretty exhausting right?

Whether you’re looking to understand which form is for estimated tax payments or for tax returns, let’s tackle the top 7 tax forms you should know when you start a business of your own!

Form W9

Otherwise known as the “Request for Taxpayer Identification Number (TIN) and Certification”, this one-page tax form is made for self-employed individuals and contractors.

The tax information within the W-9 form determines your paycheck amounts as well as the amount of tax withholdings for you to pay. It also recognizes that you’re responsible for withholding taxes from your paycheck as a self-employed person!

Form W2

A W-2 Form is a “Wage and Tax Statement” created by the IRS to record, report, and track employee wages, federal income tax, and tax returns. In other words, it’s the tax situation of any full-time American employee on paper!

W2 Forms are filled out by the employer for each employee they hire full-time in their organization or business.

It should include many important details, such as the amount of payroll taxes and fringe benefits being provided by your employer.

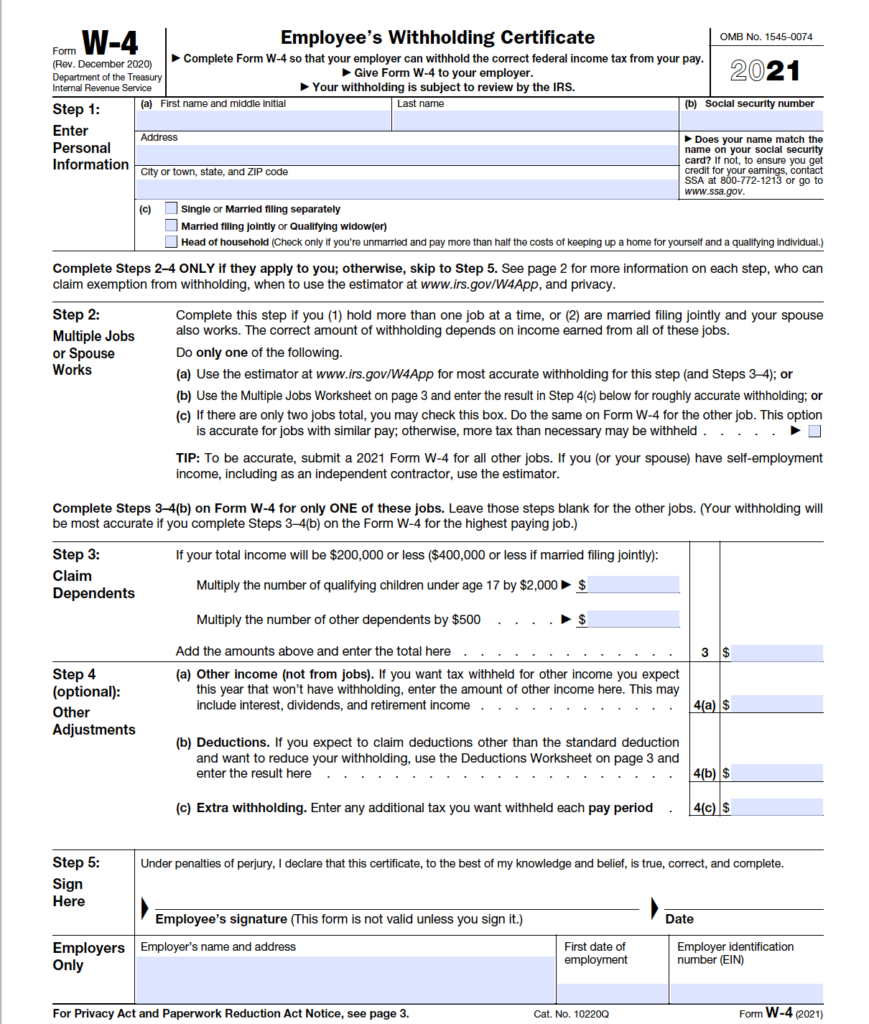

Form W4

The W-4 Form is known as the “Employee’s Withholding Allowance Certificate” and is a federal-level form meant for full-time employees to fill out. The W-4 form is used to understand how much income tax should be withheld from your federal income.

Want to know the main differences and more details on W2, W4, and W9 tax forms? Click here to find it all!

Form 1099-NEC

The 1099 form is a tax form used to report non-employment income to the IRS.

Businesses and independent contractors such as influencers and content creators are required to submit a 1099 if they’ve received at least $600 as non-employment income or more during the tax year.

Form 1120 and Form 1120S

Form 1120 is a tax form that C-corporations use to report their annual income, expenses, gains/losses, deductions, and credits to the IRS.

It’s obligatory for C-corporations and determines the corporation’s taxable income and tax liability. C-corporations are distinct tax entities, and they must make estimated payments to remain compliant and avoid penalties and interest.

When income is distributed to owners (shareholders), it’s treated as dividends and taxed at personal rates.

This is why C-corporations are often less favorable for small businesses, as earnings are subject to “double taxation” – first at the corporate level and then at the shareholder level.

On the other hand, Form 1120S is used for S-corporations and follows a format similar to Form 1120. The key difference is that an S-corporation elects to operate as a “flow-through” entity.

Much like a Partnership Form 1065, an S-corporation issues a Schedule K-1, which is reported on the individual shareholders’ personal income tax returns.

Additionally, S-corporations enjoy a tax advantage over partnerships in that their profits are not subject to self-employment taxes.

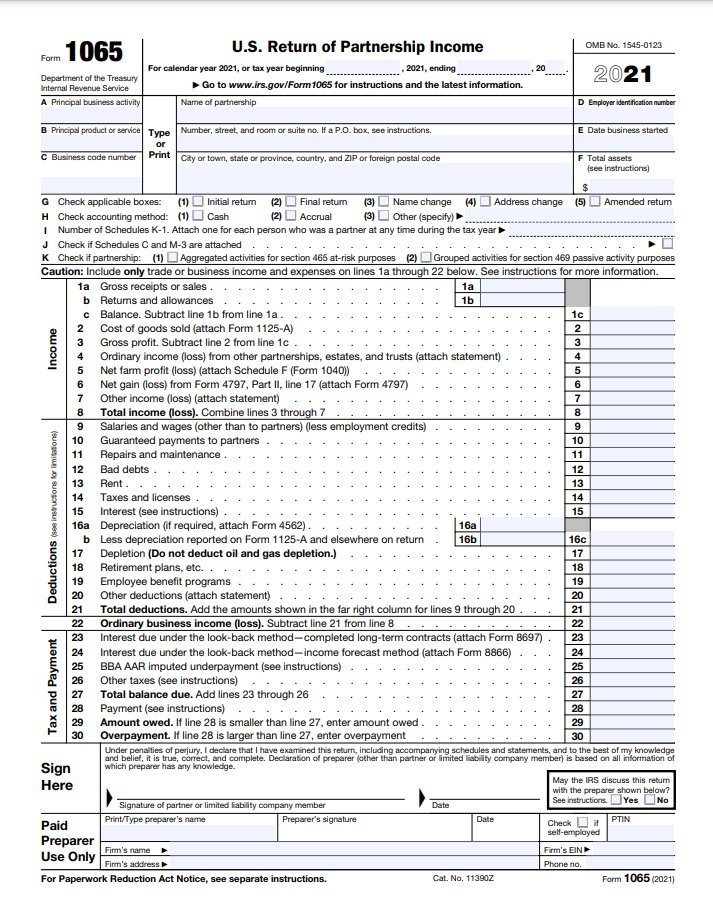

Form 1065

Form 1065 is the tax form used by partnerships to report their income, deductions, gains, losses, and credits to the IRS.

A partnership tax return is required when two or more partners jointly share:

- income,

- losses, and

- capital in a business.

The information reported on Form 1065 is used to calculate each partner’s share of taxable income, based on their portion of the partnership’s profits, detailed on Schedule K-1.

The key distinction between Schedule C and Form 1065 is that the latter’s a separate return with a distinct deadline.

Form 1065 issues a Schedule K-1, which is passed on to the partners for inclusion in their personal income tax returns.

Since the partnership’s profit or loss is reported on personal income tax returns, it’s considered a “flow-through” entity. All active partners in a partnership are subject to self-employment taxes, similar to sole proprietors.

Form 1040 + Schedule C

Form 1040 is the individual tax return form you use to report your annual income from your business as an individual taxpayer.

Schedule C is a separate form tailored for sole proprietors, single-member LLCs, and self-employed individuals. It serves as a tax profit and loss statement.

Your net profit from Schedule C flows through to Form 1040, which is your comprehensive personal tax return.

If you deduct business expenses from your total income, potentially resulting in a net loss, this loss can reduce your tax liability as a business owner.

When your business is profitable, the net income is subject to self-employment taxes at a 15.3% rate. After deducting half of the self-employment tax, your net income is then subject to federal income tax at your marginal rate.

Most Common Tax Terms to Know

Now that you know the most common tax forms for small businesses, let’s take a look at common tax terms that you should definitely know!

Deductions

Deductions are known by many other names, including tax write-offs and tax deductions. By qualifying and deducting business expenses from your taxable income, you can effectively lower your tax bill!

Deductible expenses include items such as:

- Rent (a portion of it in most cases)

- Office supplies,

- Insurance, and

- Travel expenses.

Keeping accurate records and receipts of all your business expenses is the way to go if you want to benefit from any possible deductions!

Self-employment tax

Self-employment tax is a tax that you must pay to cover Social Security and Medicare taxes.

Unlike employees who have these taxes withheld by their employers, you’re responsible for paying both the employer and employee portions of these taxes. It’s crucial for you to budget for self-employment tax as part of your financial planning.

Estimated tax

As a small business owner, you are required to make payments towards your tax bill on a quarterly basis. These payments, known as estimated taxes, help ensure that you stay on track with your tax obligations throughout the year.

The amount you pay in estimated taxes is based on your estimated taxable income for the year. If you overpay, you’ll receive a year-end tax refund, but underpayments can result in penalties.

Entity

An entity is a separate legal business entity distinct from its owners. It has its own rights, liabilities, and obligations, requiring a separate tax filing for the business.

Keep in mind that the amount of tax you pay at year-end depends on the type of entity your business is!

Pass-through entity

A pass-through entity is a business structure where profits, losses, and tax liability are passed through to you as the owner rather than being taxed at the entity level. S Corporations and LLCs count as pass-through entities!

So if your business identifies as a pass-through entity, you report the income on your individual tax return based on your ownership percentage.

Disregarded entity

A disregarded entity is tax-invisible, with 100% of its income allocated to its sole owner. You report this income on your personal tax return. Some types of disregarded entities include sole proprietorships and single-member LLCs.

Depreciation

Depreciation is a method of accounting for the decrease in value of an asset over time, such as due to wear and tear or obsolescence.

Normally, businesses are not allowed to deduct the full cost of an asset purchase immediately. Instead, you write off the cost over time via depreciation, representing the annual decrease in an asset’s value.

For instance, if you buy a computer for $1,000, you may write off $200 per year over 5 years. This gradual approach helps you recover the asset’s cost and reduces your taxable income.

Bonus depreciation

Bonus depreciation is a provision under Section 179 of the tax code that provides an additional tax benefit to businesses.

It allows you to claim extra deductions on certain types of asset purchases, reducing your taxable income for the year. The rules for claiming bonus depreciation may change from year to year.

Section 179

Section 179 is a tax provision where small businesses can deduct the total cost of any assets such as equipment or machinery.

This tax code offers businesses the advantage of immediately deducting expenses related to new assets, effectively reducing their taxable income in the year they make the purchase.

To qualify for the Section 179 deduction, these assets must be utilized for business purposes and adhere to specific requirements outlined by the IRS.

Tax credit

Tax credits are valuable tools for you as a small business owner. They are a dollar-for-dollar credit on your tax bill, directly reducing the amount of tax you owe and impacting your bottom line.

Unlike deductions, which reduce your taxable income, tax credits are a direct credit against your tax bill!

Some tax credits are refundable, meaning any unused portion is returned to you as a tax refund, while others are non-refundable, reducing your tax bill to zero without generating a refund.

Tax bracket

A tax bracket refers to the range of income levels at which different tax rates apply. Understanding your tax bracket helps you in planning and managing your tax liability effectively.

The U.S. has a progressive tax system with multiple tax brackets, and you fall into specific brackets based on your taxable income.

This is the top marginal tax rate for the tax year 2023 and will be filed in 2024:

| Rate | Single | Married Filing Separately | Married Filing Jointly | Head of household |

| 10% | $0 – $11,000 | $0 – $11,000 | $0 – $22,000 | $0 – $15,700 |

| 12% | $11,001 – $44,725 | $11,001 – $44,725 | $22,001 – $89,450 | $15,701 – $59,850 |

| 22% | $44,726 – $95,375 | $44,726 – $95,375 | $89,451 – $190,750 | $59,851 – $95,350 |

| 24% | $95,376 – $182,100 | $95,376 – $182,100 | $190,751 – $364,200 | $95,351 – $182,100 |

| 32% | $182,101 – $231,250 | $182,101 – $231,250 | $364,201 – $462,500 | $182,101 – $231,250 |

| 35% | $231,251 – $578,125 | $231,251 – $346,875 | $462,501 – $693,750 | $231,251 – $578,100 |

| 37% | $578,126+ | $346,876+ | $693,751+ | $578,101+ |

Final Thoughts

Stopping your entire business income from becoming a tax payment can be a complicated process, especially when you’re not a tax expert

But with this article, you have a solid foundation of the 7 main types of tax forms and a whole lot of tax terms you’ll come across! Bookmark this page and come back to it whenever you need to double-check the facts.

Destress Financially With Stanton Financial Co.

If you want to dive head over heels into being the creative mastermind of your brand, Stanton Financial Co. can help you.

Stanton Financial Co. is a premium bookkeeping and CFO service that brings big business strategies to small businesses, solopreneurs, influencers, and content creators.

Unlike most bookkeeping services, we make it easy for you to profitably manage your fluctuating income. Collaborate with brands and focus on doing what you do best– we’ll take care of everything else!