Do you feel like you’re never sure about your financial decisions and position? It might be due to poor principles of personal finance!

Personal finance is a term that covers many important financial management aspects. It is the knowledge, technique, and ability to maximize your income, build your wealth through savings and investments, and manage expenses and debt.

But in simple words, it’s all about managing your income to lead the best financial life today and tomorrow!

Today, we’re going to spill out 12 principles of personal finance that are the golden rules of money management! Without any further ado, let’s jump into…

12 Best Principles of Personal Finance

Set your financial goal

Picture this: you’re told to walk on a tightrope with blindfolds on. There’s no trampoline at the bottom if you fall, and you’re also no seasoned circus acrobat.

Terrifying right?

That’s what it’s like to dream about financial security and stability without a financial goal! Financial goals are the primary element when it comes to principles of personal finance because they help you achieve clarity on your present and future.

Setting a goal helps you zero in on your financial destination and actively make efforts to reach it, enabling both short and long-term planning habits. These goals are also important if you’re looking for a purpose and cut back on harmful money practices like impulsive shopping.

Financial goals can look like a lot of things for people, depending on where they are in life. Some of those examples include:

- Paying off high-interest debt (more on this later),

- Saving 10% of your income into a savings account, and

- Meeting all monthly household expenses.

Create a budget

Now that you’ve got a financial goal in place, the next order of business is creating a budget. If you’re a small business owner, entrepreneur, or influencer, chances are you’re not making a budget.

But, these tools are one of the most critical personal finance tips that help you understand your cash flow and control it. And they’re not rocket science, either!

Start by listing off every source of income for your month, such as salaries, gig payouts, or interest. Do the same for your expenses as well, including rent, bills, leisure, and other purchases. You can then organize them into a budget method of your choice.

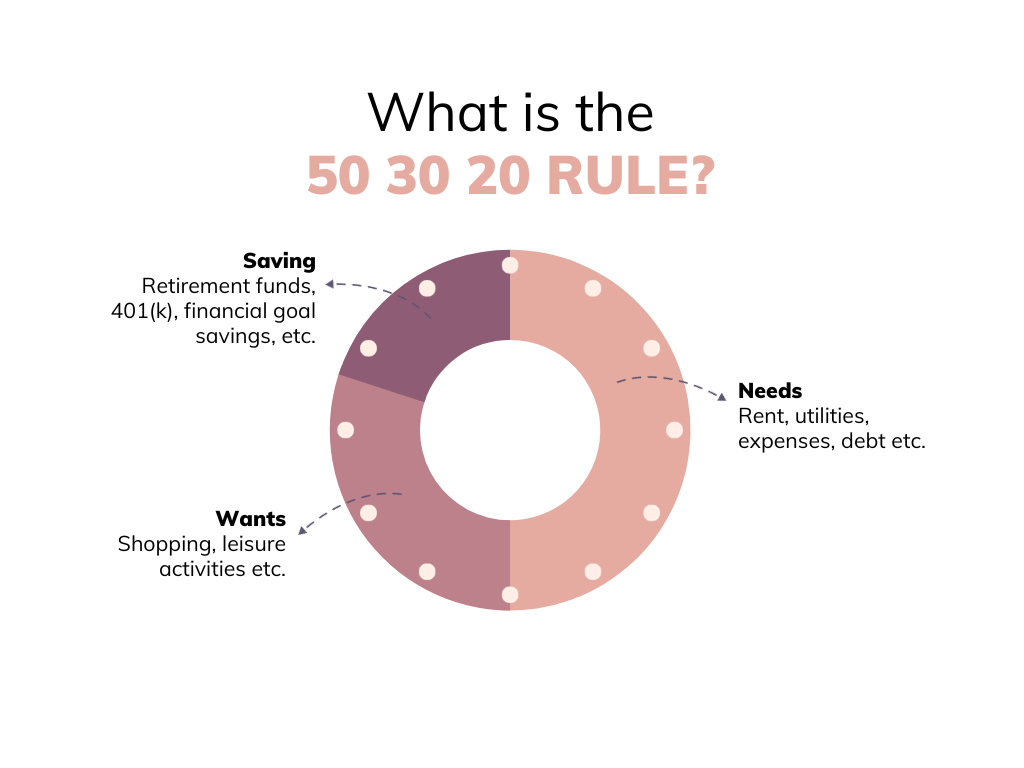

My personal favorite? The 50 30 20 rule!

Create a savings plan

Personal finance doesn’t just mean good money management. It means knowing when to save for a future expense that hasn’t appeared yet!

From your child’s college education to a down payment on your dream house, having a savings plan ensures that you’re prepared to handle these situations without resorting to high-interest loans or credit cards.

Not only does a savings plan give you a safety net to fall into, but also fosters disciplined budgeting and saving habits. So whether it’s your dream vacation or a down payment on a house, make sure you’re saving for it with a structured plan and regular input!

Acknowledge your debt

Acknowledging your debt is a critical first step toward effective debt management and financial well-being. Ignoring or denying debt only worsens financial problems and can lead to a cycle of escalating financial stress.

You might have student loans, mortgages, credit card bills, or any other type of debt. Acknowledge how much you owe and keep a record of everything on your end to gain financial clarity.

Once you acknowledge your debt, you can begin to assess your financial resources and explore options for repaying what you owe, such as budgeting, debt consolidation, or negotiation with creditors. It also allows you to prioritize debt repayment and make informed decisions about your financial priorities.

Pay debts with the highest interest rate first

When you prioritize high-interest debts, you’re tackling those loans or credit cards that are accruing interest at a faster rate, which means you’ll pay less in interest over time. This approach saves you money and accelerates your journey to becoming debt-free!

High-interest debts, like credit card balances or certain types of loans, can quickly become a financial burden due to their compounding effect. The interest on these debts accumulates on the outstanding balance, causing the total amount you owe to grow rapidly.

By targeting these high-interest debts first, you reduce the overall interest you’ll pay, freeing up more of your money for other financial goals or needs.

Only invest in what you understand

A lot of us feel like the world of investment is a glittering pool of money. A gold rush too perhaps!

But you shouldn’t jump at the first investment opportunity that comes your way. Understand the option, do a cost-benefit analysis, and make sure you’re not putting all your eggs in one basket.

Aim to invest in familiar assets and industries because it gives you a deeper understanding and logical approach to investments.

Emotional reactions can lead to irrational investment choices and potentially result in losses. When you invest in what you understand, you’re less likely to be swayed by market volatility or external factors that might tempt you to deviate from your long-term investment strategy.

A good personal finance rule of thumb is to diversify your investment portfolio as much as possible. This can be in stocks, real estate, mutual funds, or even bonds!

Live within your means

Living within your means is one of my main principles of personal finance because it ensures financial stability and security. When you spend less than you earn, you avoid accumulating debt, achieve your financial goals, maintain control, and reduce financial stress in your life.

Before making non-essential purchases, give yourself a cooling-off period. Ask if the item is a genuine need or just a want. Or review your budget and set spending limits for each category!

Create an emergency fund

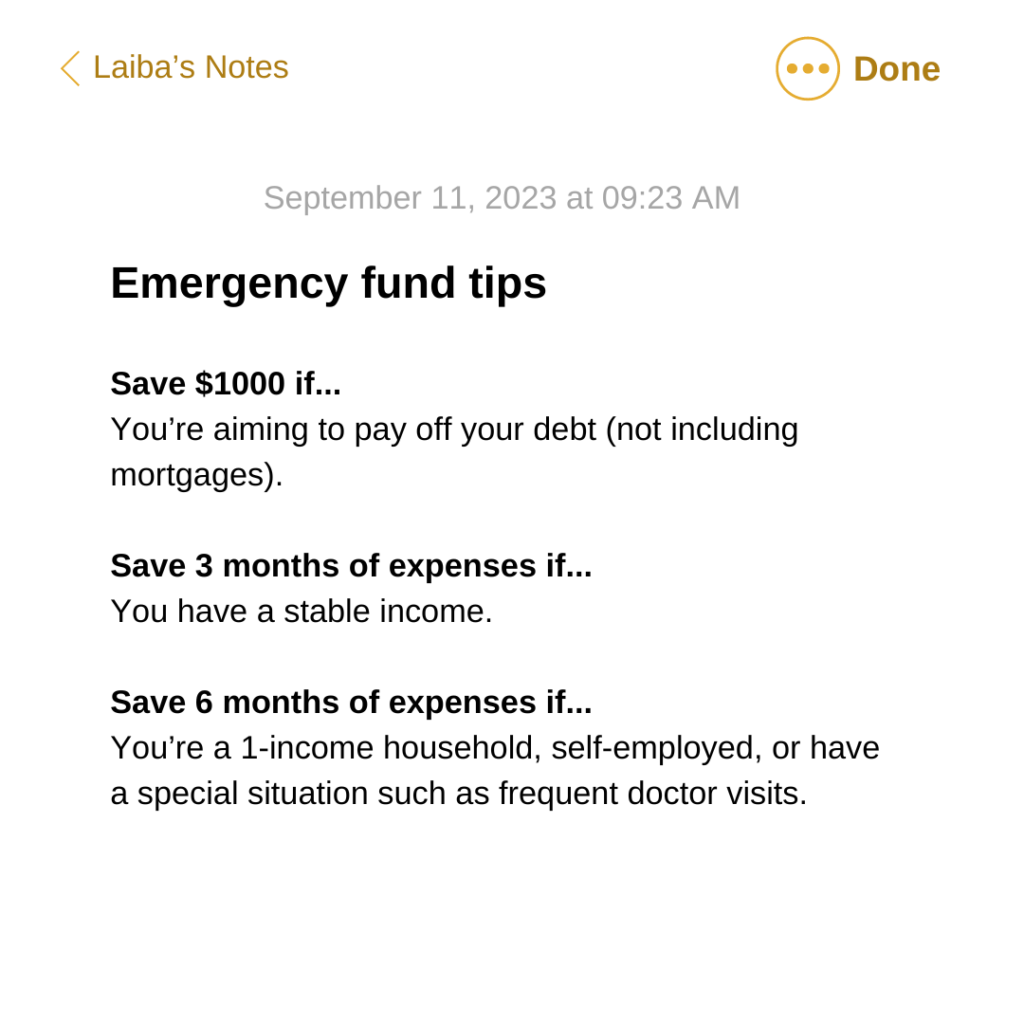

Life is inherently unpredictable, and unexpected events like medical emergencies, car repairs, or job loss can disrupt your financial stability.

That’s why emergency funds are a personal finance tip that I’ve repeated time and again in my blog posts. These funds aren’t created to pay for your needs, wants, or planned savings. They’re only there to protect you against any financial shocks you might face and help you gain financial stability and freedom!

Tip: Add a set amount to your monthly budget for emergency funds to save up approximately 6 months of your salary.

Understand credit

Credit refers to the ability to borrow money or access goods and services with the understanding that you will repay the borrowed amount, often with interest, in the future. Credit can appear as:

- credit cards,

- Loans,

- Mortgages, and

- The interest rates and fees associated with each of these!

Understanding credit is the paved way to responsible financial management because it teaches you when and how to use credit. Credit can impact your financial opportunities and future.

Lenders and creditors use your credit history and credit score to assess your creditworthiness when you apply for loans or credit lines. A strong credit history can open doors to favorable terms and lower interest rates, potentially saving you money over time.

You can improve your credit by:

- Paying off your credit bill every month no matter what,

- Avoiding making credit purchases and instead focus on debit or cash,

- Download a monthly credit report.

Gain financial knowledge

There’s no strict age of learning. And the best way to improve your personal finance game over time is to actively gain financial knowledge.

The good news is that there are many ways you can incorporate this principle of personal finance into your life! From reading personal finance blogs and the best personal finance books to listening to financial podcasts and subscribing to newsletters, there’s no shortage of authentic knowledge!

Hot tip: Scroll to the bottom of this page and sign up for our weekly newsletters for more financial knowledge and personal finance tips!

Learn the rule of 72

The Rule of 72 is a simple formula used to estimate how long it will take for an investment or savings to double in value, assuming a fixed annual rate of return. It’s a handy tool for quickly assessing the potential growth of investments or the impact of inflation on savings.

To use the Rule of 72, you divide 72 by the annual interest rate (expressed as a percentage) or the annual rate of return.

For example, if you have an investment that is earning a consistent annual return of 6%, divide 72 by it. That would mean it takes your investment 12 years to double.

Start planning for retirement

Retirement might feel like eons away, but don’t let time fool you from securing your future. Saving now can build you a wealthier nest to enjoy in your golden years. No matter what method of retirement funds you choose, your money multiplies the longer you leave it in there, so make sure to start early!

I recommend setting aside at least 15% of your net pay as savings and automating the process, so you never miss out on funding your future!

Be Wise with These Principles of Personal Finance

Personal finance means managing your money to cover your expenses and save for a stable future. It sheds light on the importance of 5 aspects of financial literacy, such as:

- income,

- spending,

- Savings,

- investing, and

- protection.

While personal finance tips can often feel like a never-ending list of complications, they are there to help you gain financial freedom and stability. It’s the knowledge and techniques to lead a better lifestyle where money is the least of your problems.

And with this blog post by your side, you can build a solid foundation for your financial future by mastering the basic principles of personal finance!

Destress Financially With Stanton Financial Co.

If you want to dive head over heels into being the creative mastermind of your brand, Stanton Financial Co. can help you.

Stanton Financial Co. is a premium bookkeeping and CFO service that brings big business strategies to small businesses, solopreneurs, influencers, and content creators.

Unlike most bookkeeping services, we make it easy for you to profitably manage your fluctuating income. Collaborate with brands and focus on doing what you do best– we’ll take care of everything else!