Successful businesses do one thing that failing ones don’t: They track financial KPIs for small businesses!

KPIs or key performance indicators are a deep-dive method to understand your business’s health.

From calculating gross profits and revenue to tracking business expenses, KPI metrics for small businesses help your business achieve its goals by aiding you in informed decision-making!

But what are KPIs in business, and which ones should you track for yours?

In this blog, I’ll elaborate on the 15 best KPIs for small businesses that you need to start tracking in your business KPI dashboard! Ready to get a precise snapshot of your business?

What are KPIs in business?

Key performance indicators (KPIs) are quantifiable metrics used to measure and evaluate the performance of various aspects of a business, such as sales, customer satisfaction, profitability, or operational efficiency.

They provide actionable insights into whether a company is meeting its goals and objectives, helping you make informed decisions and track progress toward strategic targets.

Why are KPIs important?

Small business KPIs help companies achieve their business objectives in more ways than one. In other words, there are 4 main reasons you should start tracking key financial metrics for small businesses.

Shows how business is performing

Small business owners often tend to become bogged down in day-to-day activities and fail to align efforts with their long-term goals. Unlike corporations and enterprise-level entities, small businesses can fail because of any minor setback, since they don’t have the financial or managerial safety net as the former.

But by tracking their KPIs, you can translate performance into numbers and take control of the narrative.

KPIs matter because they offer a precise and quantitative tool for monitoring how well your business is performing. When you start tracking the numbers and trends, you can figure out if you’re getting closer to your goals or whether you need to make any adjustments.

Helps reveal and mitigate any future risks

Your internet has a firewall to protect you from threats. Your business has KPIs.

Many small businesses are extremely volatile, meaning that even the slightest of blows can send them crumbling down. Acting as early detection mechanisms, KPIs can identify, mitigate, and help you minimize threats.

When your KPIs show you an alarming number that’s out of the ordinary, it’s time to check into the fine print and find out why it’s happening.

Let’s say your liquidity ratio shows your business has bled dry and has low cash in motion. To mitigate the risk of going practically out of business, you can sell underperforming assets to improve liquidity!

Improves your competitiveness

Competitiveness is part of chasing success. As a small business, you have tons of competition everywhere, from small businesses to large corporations.

But KPIs can help you figure out where you land against these competitors. Performance metrics from competitors can be analyzed and used to streamline your business process. Even better, you can ensure your metrics are more profitable by making adjustments to beat your competition!

Ensures survival and growth

Small businesses need to survive over the long term. Tracking key performance indicators becomes important to ensure the development of sustainable growth plans and avoid errors that can endanger your company’s existence.

Form a habit of maintaining a month-end close checklist for your small business to stay focused on your financial goals and adjust them where need be.

15 Important Metrics and KPIs for Small Businesses

Here are 15 performance indicators you should track to get your business success:

1. Revenue

Revenue is the overall income from sales or services. It’s the top-line figure that represents the money flowing into your business and is a fundamental indicator of your financial health.

By tracking revenue regularly, you can assess whether your business is growing, stagnant, or facing declining income.

Revenue tracking offers useful insights into the overall performance and financial health of your small business. It reflects your ability to grow your business, attract new customers, increase sales to existing customers, and expand your market share.

2. Expenses

Expenses refer to the costs incurred in running and maintaining the business. Hence, this is where you look when you want to know where your hard-earned money is going. You can categorize and quantify your various costs, such as rent, utilities, employee salaries, supplies, and more.

Tracking this KPI is important for the future of your business! It aids in identifying and analyzing expenses and can lead to cost-cutting opportunities. You can also make informed decisions about where to reduce spending or find more cost-effective alternatives.

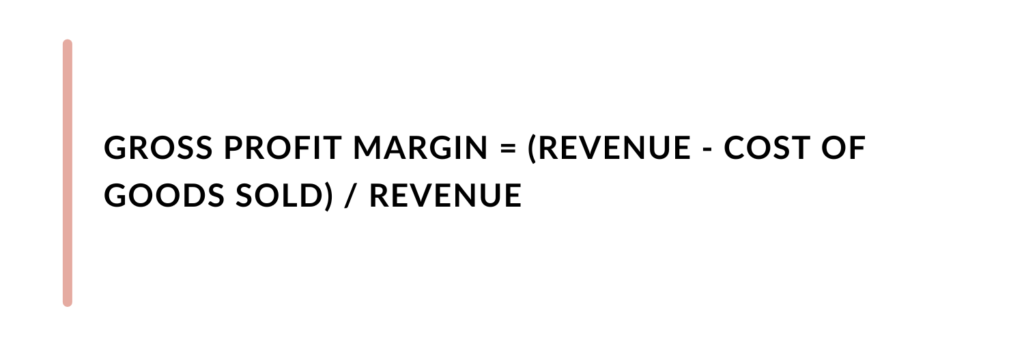

3. Gross Profit Margin

Gross profit margin measures the profitability of a business’s core operations by calculating the percentage of profit remaining after deducting only the direct costs associated with producing your product or service.

It’s important to track this useful KPI because it tells you how well you manage the direct costs, revealing your cost-effective strategies.

By understanding your gross profit margin, you can set appropriate prices that allow you to maintain profitability while remaining competitive in the market.

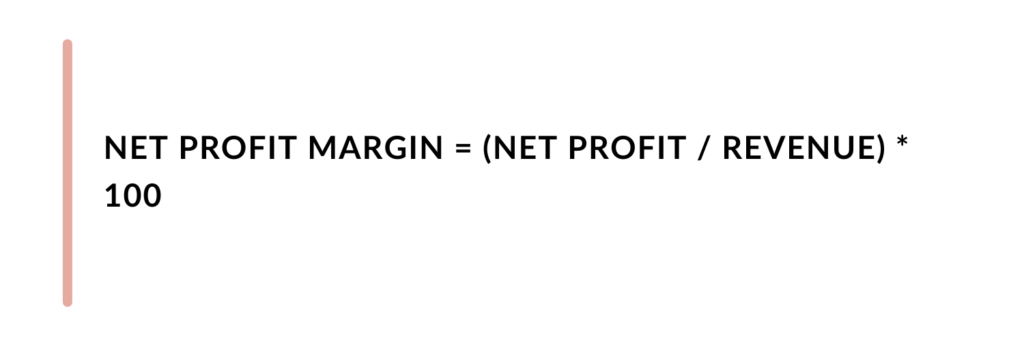

4. Net Profit Margin

Net Profit Margin is a KPI that measures the profitability of a business by calculating the percentage of profit remaining after all expenses, including operating costs and taxes, have been subtracted from the total revenue.

It’s one of the most essential KPIs for small businesses, as it provides valuable insights into how much the business earns and retains after all expenses have been paid for.

Regularly tracking and analyzing this metric enables small business owners to make informed decisions, identify opportunities for cost control and revenue growth, and enhance their financial stability.

It’s a valuable tool for small businesses looking to ensure long-term success and sustainability in a competitive business environment.

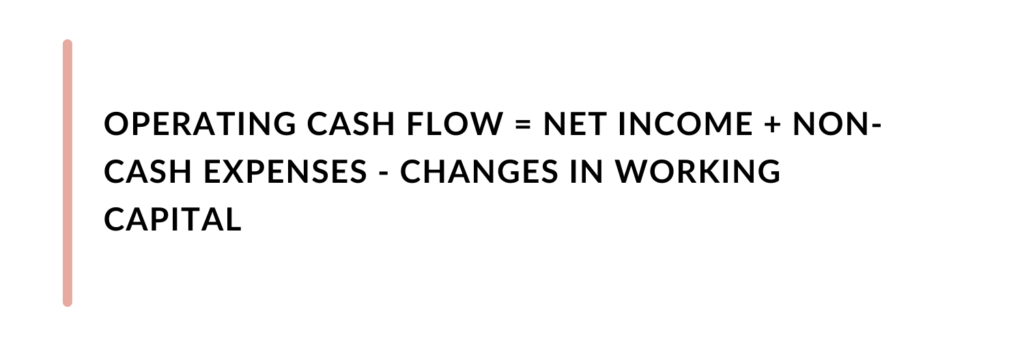

5. Operating Cash Flow

Operating Cash Flow (OCF) measures the cash generated or used by a business’s core operating activities. OCF is an example of a KPI that reflects the financial health and sustainability of a small business by evaluating its ability to generate positive cash flow from its primary operations.

OCF is important to your business as it helps assess the company’s liquidity by determining whether it has enough cash generated internally to cover operating expenses, debts, and capital expenditures.

6. Working Capital

This KPI shows how stable your business’s short-term financial health is and reflects its ability to meet its day-to-day operational obligations.

Working capital measures the liquidity and efficiency of your business by evaluating the difference between its current assets and current liabilities. It’s always a good idea to have greater assets than liability, as it indicates your business is liquid and has more cash inflow than outflow.

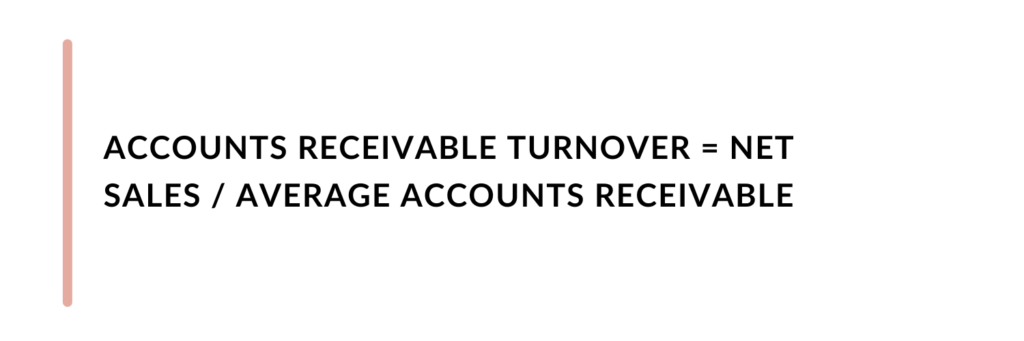

7. Accounts Receivable Turnover

This indicator helps you assess how efficiently you manage the amounts owed to your business by its customers, for products or services provided on credit.

Accounts receivable turnover assesses how quickly your business collects payments from its customers and can provide insights into cash management and customer credit risk.

Understanding your receivable turnover is crucial and can help you improve your cash flow strategy and keep your business highly liquid!

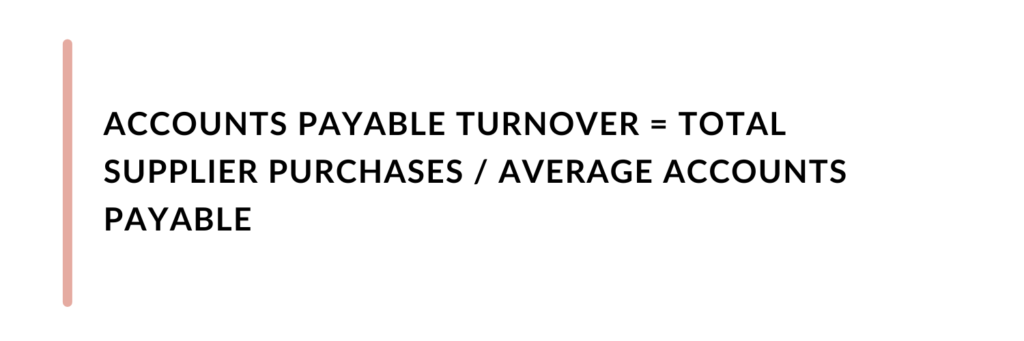

8. Accounts Payable Turnover

Accounts payable turnover measures how efficiently you manage your accounts payable, which are the amounts you owe to suppliers and vendors for goods and services received on credit.

This excellent KPI for small businesses helps assess how quickly a business pays its bills and analyzes cash flow management, supplier relationships, and operational efficiency.

While it’s great to practically have a long duration before you need to make any payments, a good payable ratio would be between 8 and 10 days.

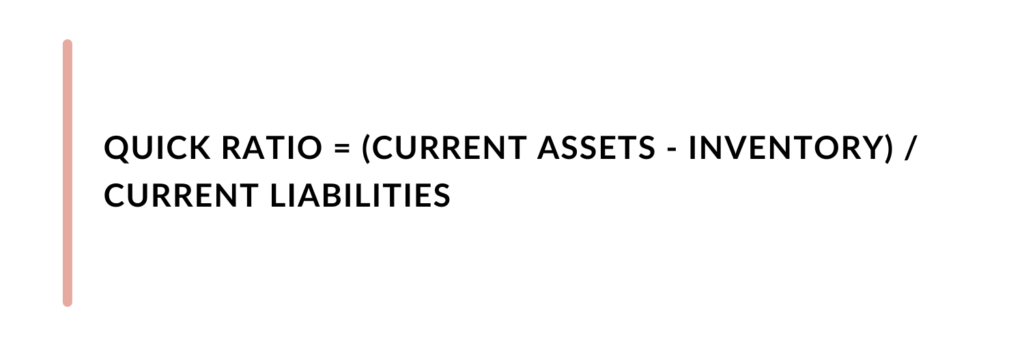

9. Quick Ratio

Also known as the Acid-Test Ratio, the quick ratio measures your business’s ability to meet its short-term financial obligations using its most liquid assets, excluding inventory.

It provides insight into a business’s liquidity and its capacity to cover immediate liabilities without relying on inventory sales.

A healthy quick ratio can improve a small business’s credibility with creditors and suppliers. It demonstrates a company’s capacity to settle debts promptly, which can lead to better terms, credit lines, and supplier relationships.

Monitoring the quick ratio can prompt small businesses to streamline operations and inventory management, potentially reducing costs and improving overall efficiency.

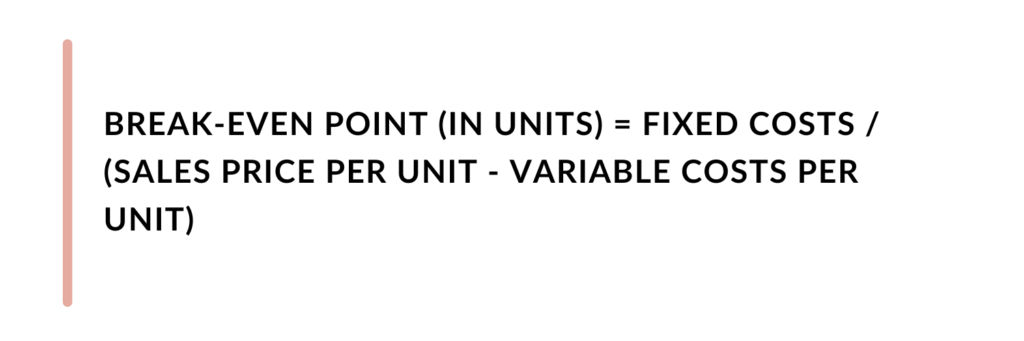

10. Break-even Point (BEP)

Break-even represents the level of sales at which a business’s total revenue equals its total expenses, resulting in zero profit or loss. You’re not making money, but you’re not losing any either!

Oftentimes, small businesses fail to break even because they have high fixed costs, such as rent, utilities, and salaries, especially if they don’t have a sufficient customer base to cover these expenses. But you only realize this when you calculate BEP.

EP helps small businesses determine the minimum level of sales needed to cover all costs, ensuring financial stability. It encourages cost control and efficiency improvements, which can enhance profitability. Furthermore, monitoring this financial KPI helps you assess financial risk and prepare for unexpected downturns or economic challenges by making strategic decisions!

11. Average Customer Acquisition Cost (CAC)

Average Customer Acquisition Cost measures the cost associated with acquiring a new customer and undoubtedly one of the most important KPIs for small businesses.

It helps you understand how efficiently you’re using your resources to gain new customers and is essential for making informed marketing and sales decisions. CAC measures how efficiently a business converts its marketing and sales efforts into actual customers.

By tracking CAC, small businesses can allocate their marketing and sales budgets more effectively, ensuring that they’re investing in strategies that provide the best return on investment (ROI).

12. Return on Investment

When we’re compiling a list of the most important KPIs for small businesses, we couldn’t miss this one! Return on Investment (ROI) is a great KPI that measures the profitability of an investment or expenditure relative to its cost.

It provides insight into how effectively a business generates profit from its investments and is essential for decision-making, resource allocation, and assessing the overall financial health of the business.

Small business owners can use ROI to evaluate the potential return before making an investment decision. It also helps prioritize investments that are likely to yield the highest returns, instead of the other way around.

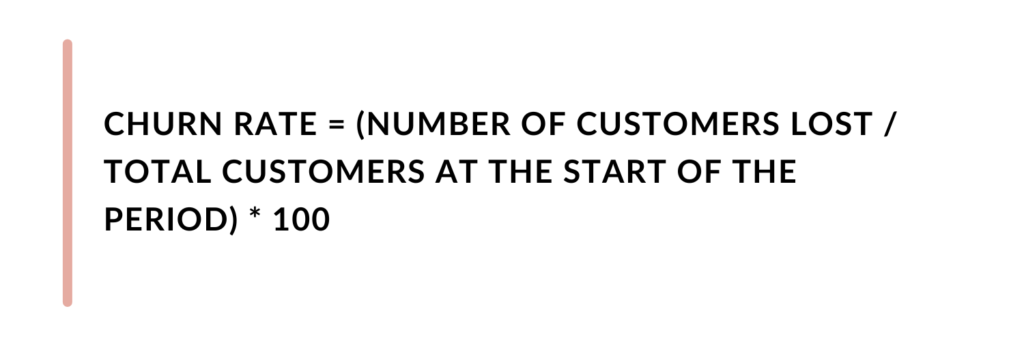

13. Churn Rate

Churn Rate measures the rate at which customers or clients stop doing business with the business over a specific period. It’s a critical metric for assessing customer retention and the overall health of the customer base.

By tracking the churn rate, small businesses can gauge whether their products, services, or customer experience are meeting customer expectations.

A high churn rate may indicate issues that need addressing, such as product quality, customer service, or pricing. On the other hand, a low churn rate means your clients are spending a lot of time with you and have a high value associated with you!

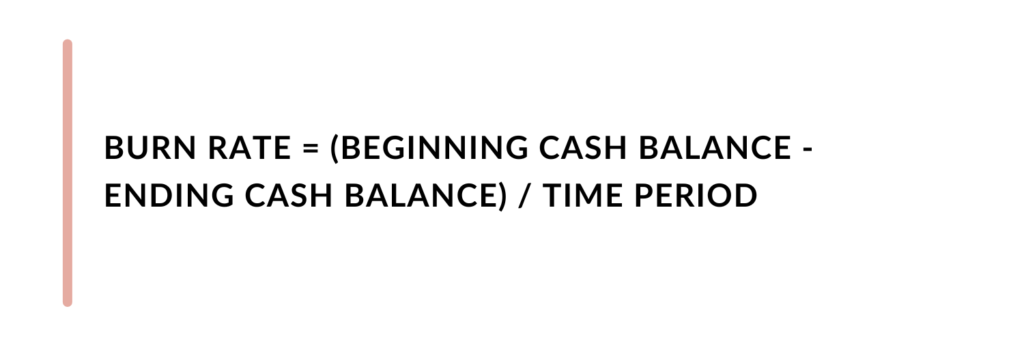

14. Burn Rate

Burn rate is the rate at which a company consumes its available cash or funding over a specific period, typically measured monthly.

For small businesses, understanding the burn rate is critical because it provides insights into their financial health and sustainability. It reveals how long the existing cash reserves can sustain the company’s operations, aiding in financial planning and risk mitigation.

By monitoring burn rate, small businesses can make informed decisions about resource allocation, cost-cutting, or expansion strategies.

It serves as a financial compass, guiding you to optimize your operations and adjust spending patterns to ensure long-term viability. In essence, burn rate is a critical tool that helps small businesses navigate their financial journey effectively.

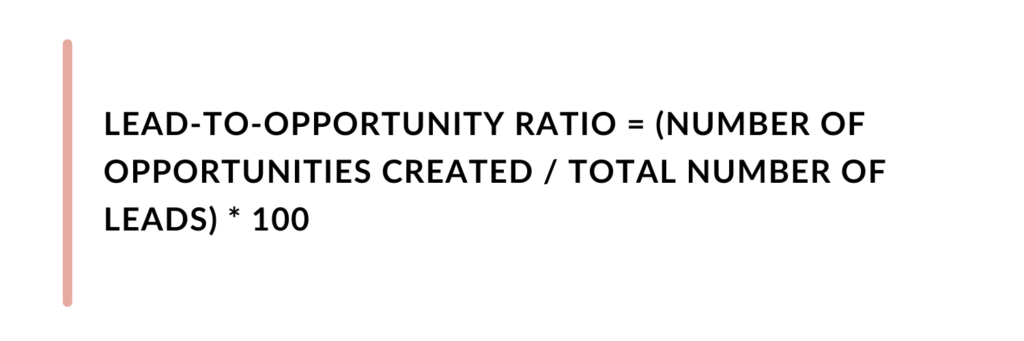

15. Lead-to-opportunity Ratio

The Lead-to-Opportunity Ratio is one of the marketing and sales KPIs for small businesses that quantifies the effectiveness of a business’s lead generation and conversion process.

It measures the proportion of generated leads that ultimately become sales opportunities. For small businesses, this metric is vital because it reflects the efficiency of their sales and marketing efforts.

A high lead-to-opportunity ratio signifies efficient lead qualification and a strong sales pipeline, while a low ratio may indicate the need for better targeting or lead nurturing.

By tracking this ratio, small businesses can refine their marketing strategies, focus on quality leads, and allocate resources effectively, while enhancing the overall sales process to boost revenue and profitability. In short, It provides actionable insights to drive business growth!

Final Thoughts

In today’s competitive business landscape, you’re operating blindly if you don’t track your business’s performance with different key metrics! Small businesses that diligently track their KPIs not only increase their chances of survival but also position themselves for success.

This list of KPIs for small businesses is all you need to help stay on track while you grow your small business. By utilizing these metrics as your guiding compass, navigate the challenges, seize the opportunities, and ultimately realize your vision of a prosperous future.

Destress Financially With Stanton Financial Co.

If you want to dive head over heels into being the creative mastermind of your brand, Stanton Financial Co. can help you.

Stanton Financial Co. is a premium bookkeeping and CFO service that brings big business strategies to small businesses, solopreneurs, influencers, and content creators.

Unlike most bookkeeping services, we make it easy for you to profitably manage your fluctuating income. Collaborate with brands and focus on doing what you do best– we’ll take care of everything else!